An Inheritance Cash Advance Puts Money In Your Bank Tomorrow.

An Inheritance Cash Advance Puts Money Your Bank Tomorrow.

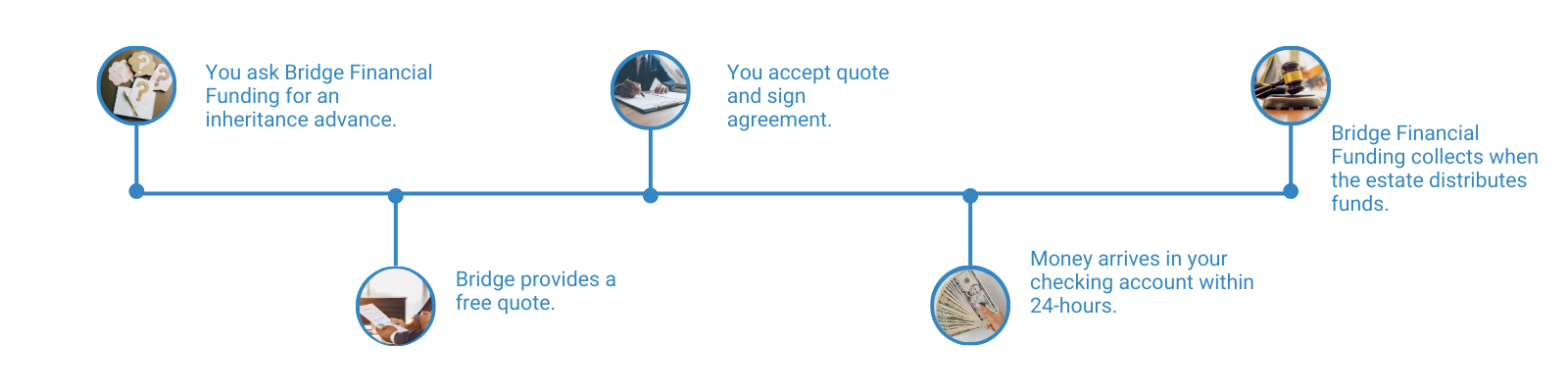

Stuck in Probate? Getting An Inheritance Advance Is Fast and Easy.

Stuck in Probate? Getting An Inheritance Advance Is Fast and Easy.

Cash In 24-Hours or Less

From the time we agree on terms to when cash can be in your bank account is less than 24-hours.

No Credit Check

Because it is not a loan, no credit check is needed.

No Income Verification

The advance is based on your estimated inheritance amount, not your income.

Direct Deposit

We transfer the money directly to your bank. No waiting period for access to your funds.

Pay Off Debt

The inheritance advance is a great way to pay off expensive high-interest loans and credit cards.

Cover Unexpected Emergencies

Sometimes unexpected needs arise. An advance on your inheritance can help.

Improve Credit Score

Eliminating debt will improve your credit.

Avoid Bankruptcy or Eviction

If you are on the verge of losing your home or being evicted, there is no faster way to stay in your home.

All Your Probate and Inheritance Advance Questions Answered.

What is an assignment?

An assignment is a portion or all of the expected inheritance from an heir, “assigned” to another person or entity.

Bridge Financial Funding advances money to heirs in exchange for an assignment valued at the amount of the advance given plus a fee that is agreed upon prior to the advance being made.

Can I get another inheritance advance later?

You can always get another advance as long as there is still available inheritance money to assign. For that reason, we encourage our clients to only take an advance for what they need. This allows the heir to keep as much of their inheritance as possible.

What is the interest rate?

There is no interest rate. It is a fixed free that we charge.

What if my inheritance is less than expected?

No. This is not loan or debt. If for some reason the estate distributes out less funds than the advance + fee, then is Bridge is not able to collect the full amount. There is nothing you need to pay to Bridge.

Does the fee increase if probate lasts longer than expected?

No, the fee never changes.

Does this negatively impact my credit?

No, there is no impact. We do not do credit checks. Because we get paid by the estate, and not you, this does not count as debt. In fact, this is a great way to pay off expensive debt and improve your credit scores.

How does my inheritance advance impact other heirs on the estate?

It has no impact on other heirs. The assignment comes from your allotted estimate inheritance, not from the overall estate.

How does Bridge Financial Funding get it’s money back?

When the estate is ready to distribute funds, the courts order whomever is responsible for making those distributions, to pay the assignments first. Because you “assign” Bridge a portion of your inheritance in exchange for a cash advance, we are on that list of payees by the court.

Lift The Weight Of Financial Uncertainty With An Inheritance Advance.

Lift The Weight Of Financial Uncertainty With An Inheritance Advance.

Get Money In Your Bank Account By Tomorrow!

If the probate process is taking too long for your financial demands – you need Bridge Financial Funding.